Fast KYC onboarding for bank card

Kasta launched its own Kasta Visa Card with a credit limit and extra discounts in the marketplace, available only in the mobile app. As Senior Product Designer, I redesigned the entire onboarding / KYC flow so that users could open a fully‑featured banking card quickly and confidently, without breaking any bank, legal or compliance rules. The result: around 500 new cards opened per day and a clear uplift in completion, KYC pass rate and early activation.

Context

Kasta is launching its own Visa card with a credit limit and exclusive benefits inside the marketplace.

The onboarding is a full‑scale banking KYC process with strict legal and technical requirements.

Key constraint: we cannot simplify onboarding by removing steps — the entire logic of the existing process must be preserved.

Problem

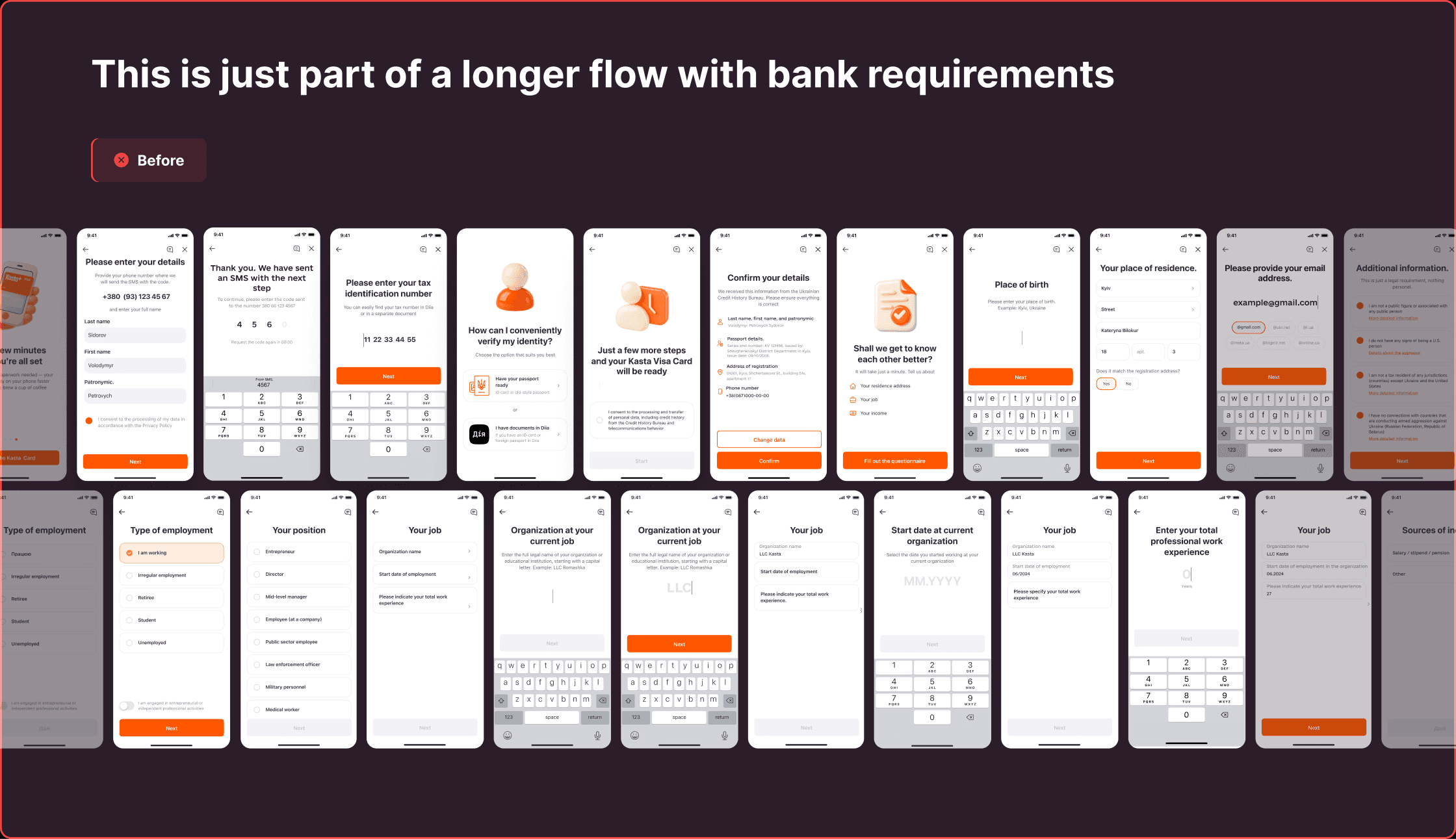

The original onboarding behaved like a classic bank wizard:

20+ screens

Fragmented, many tiny steps with no clear sense of progress

High fear factor: passport photos, selfies, legal wording, multiple signatures

Users dropped out halfway, often before they even saw the benefits of the card

Result: low completion rate, noticeable drop‑off at KYC steps, and user fatigue before any value appeared.

Business goals

Completion rate ↑

More users successfully finish onboarding and open the card.

Early activation ↑

Users start paying with Kasta Visa Card immediately after opening.

KYC drop‑off ↓

Fewer users abandon the flow on identity verification and document steps.

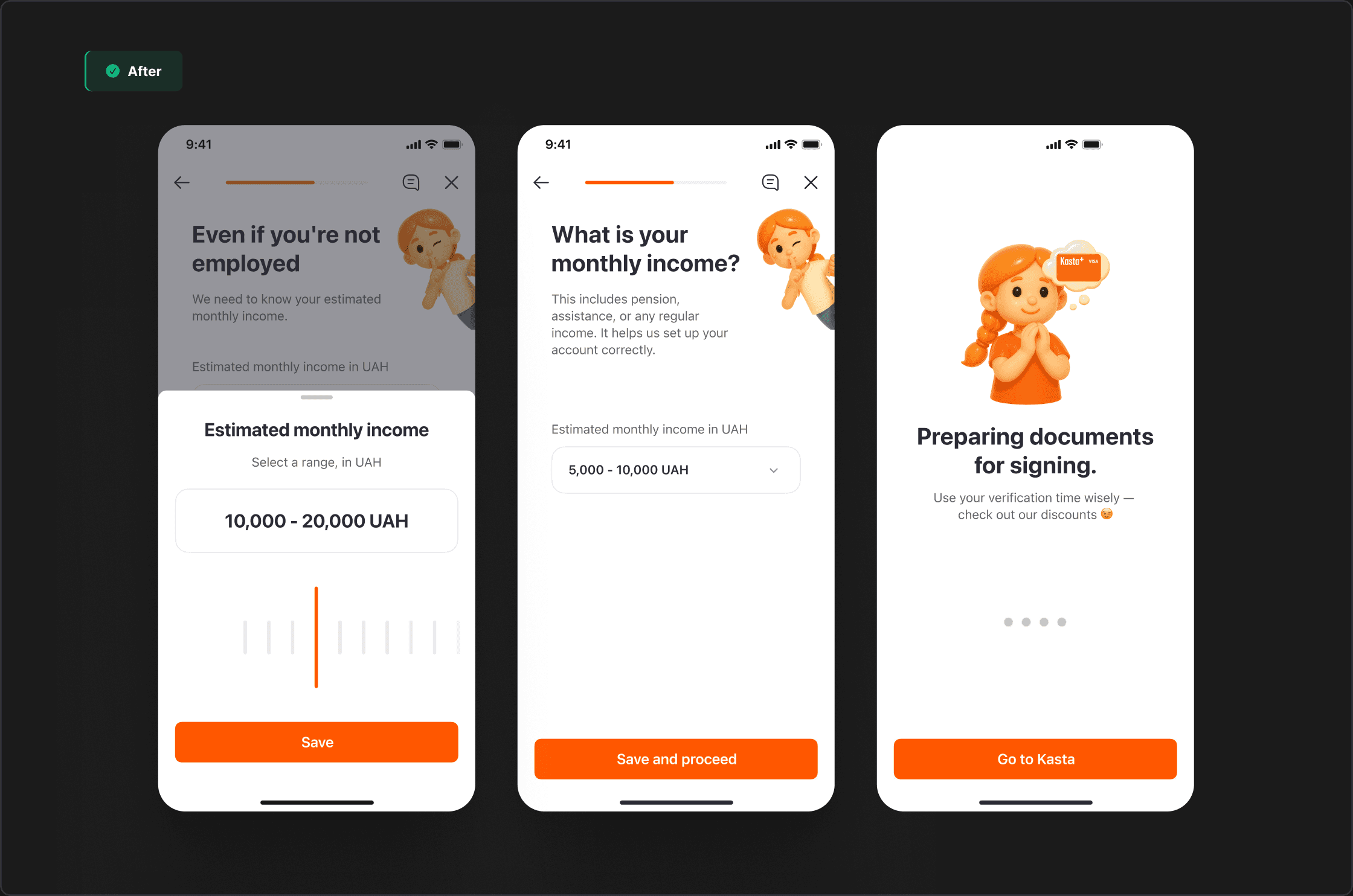

Perceived time ↓

The process feels faster and lighter through progress, feedback and fewer micro‑decisions.

Architecturally this was not about shortening KYC, but about reducing the number of decisions and the level of fear the user has to go through during onboarding

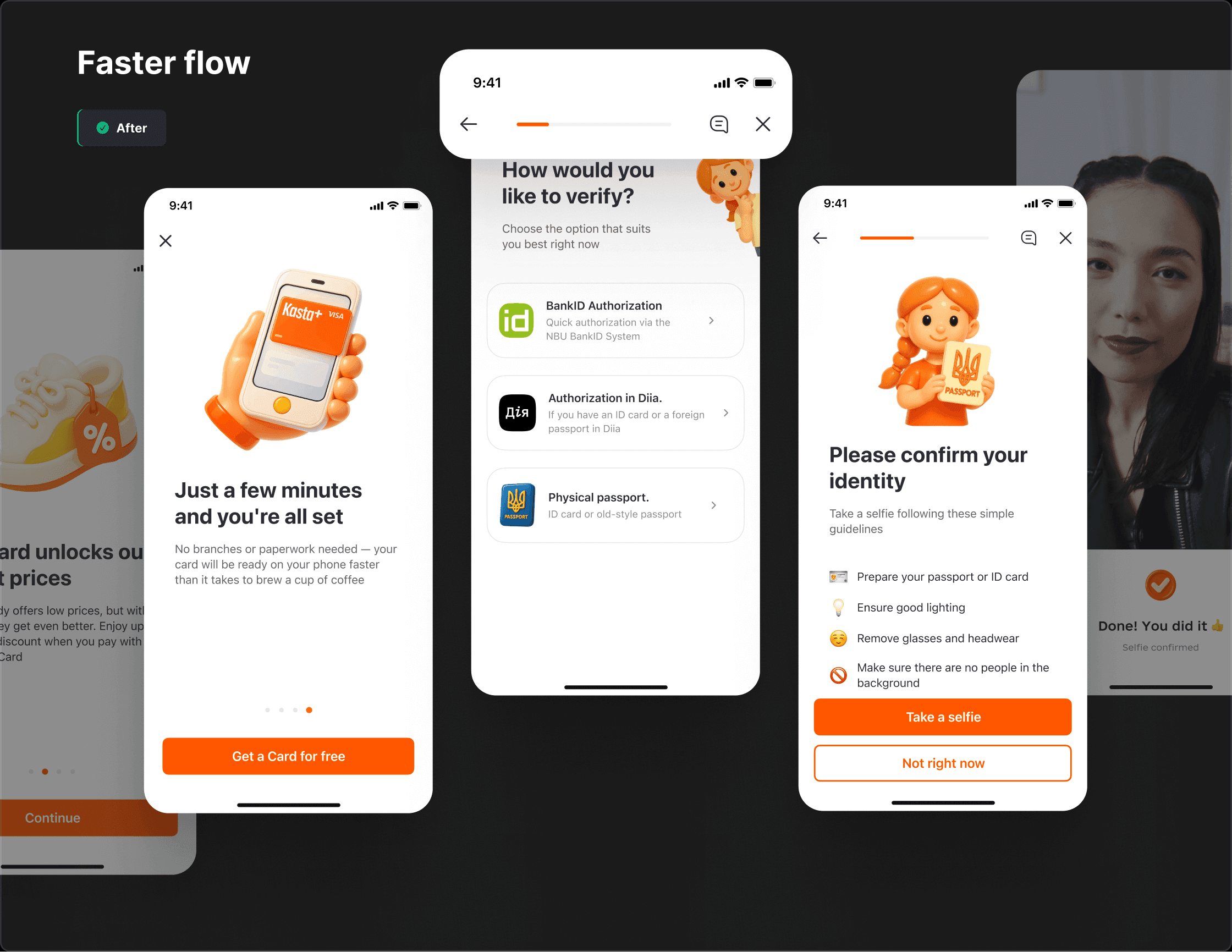

Faster and more friendly KYC flow

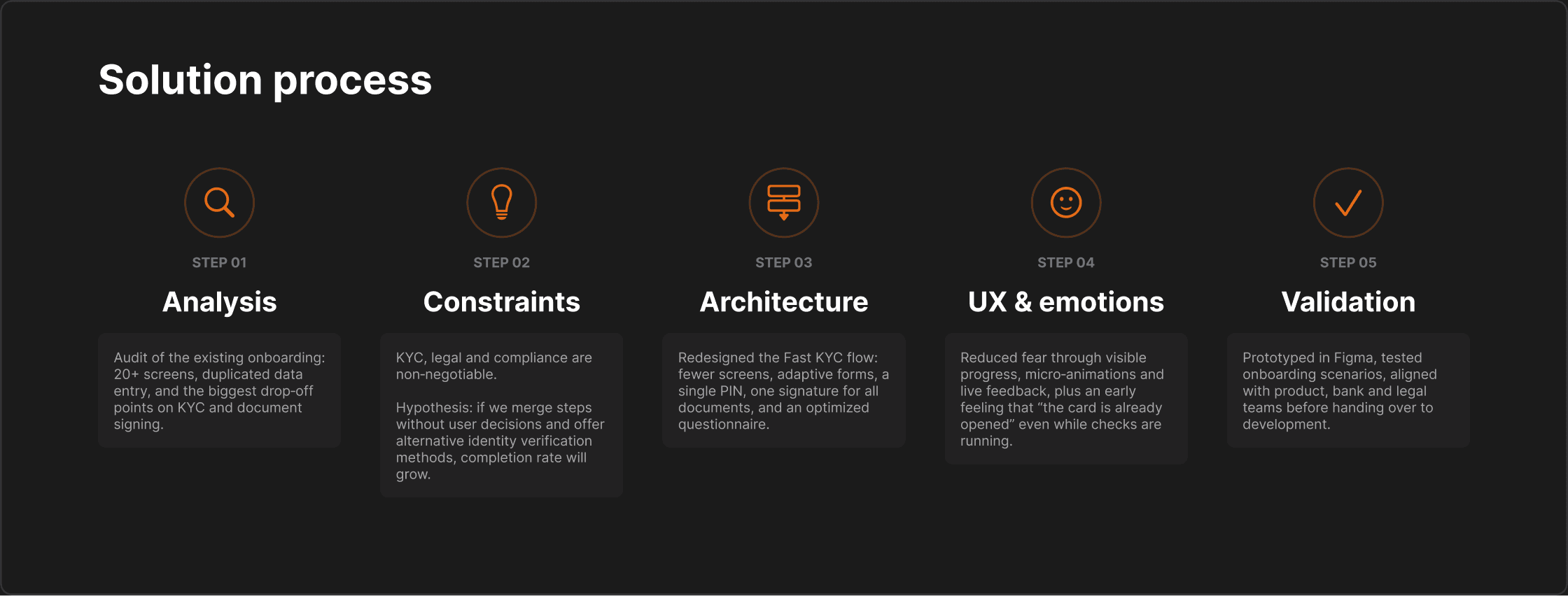

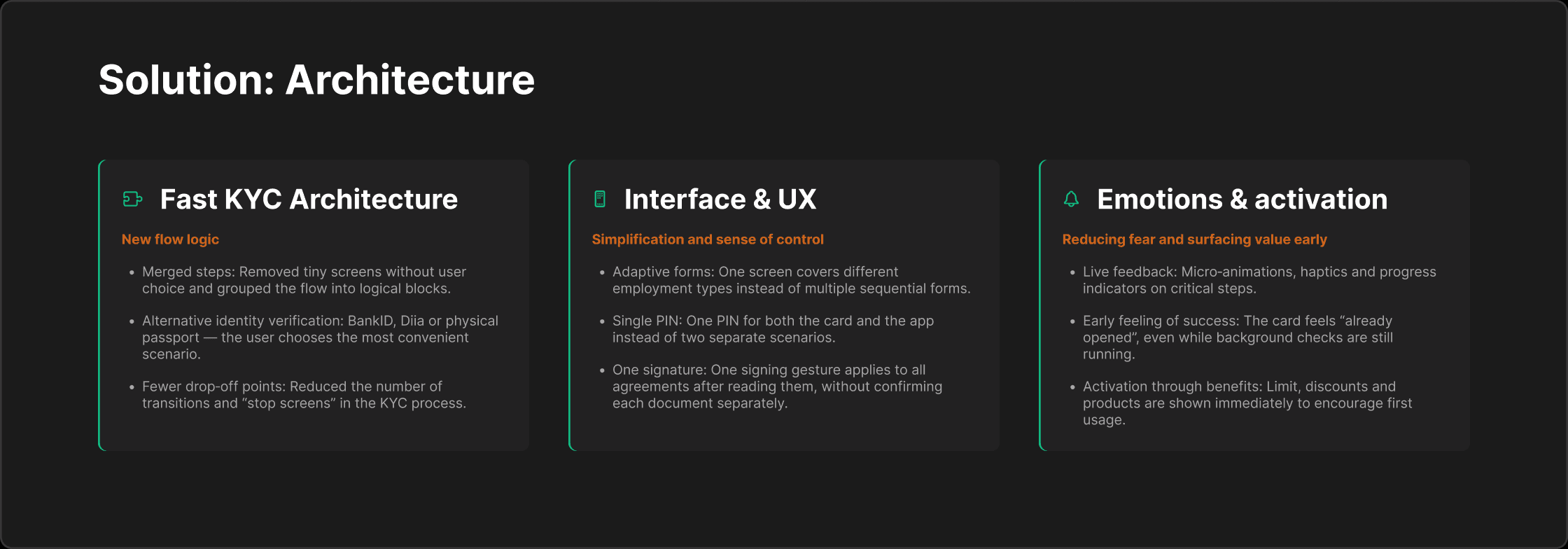

Merged 20+ fragmented screens into logical blocks with alternative verification (BankID/Diia/passport), single 4‑digit PIN for card+app, one signature for all documents, live progress feedback and immediate value shown — while preserving all KYC/compliance logic.

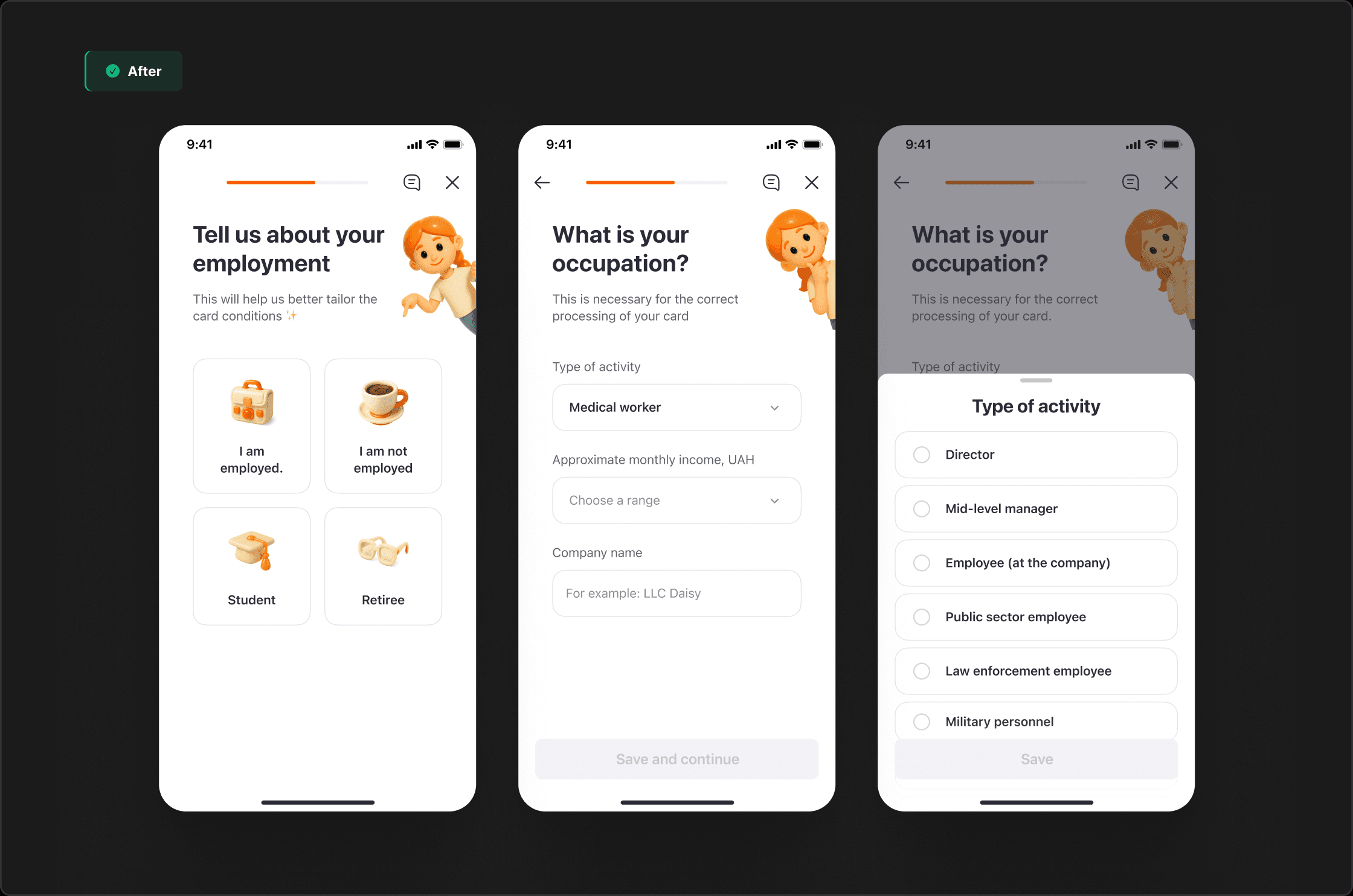

Modal steps instead of extra screens

Mandatory steps were regrouped so that roughly half of them became lightweight modal dialogs instead of full pages. This made the flow feel faster and less tiring: instead of jumping between two separate screens, users stay on the same context and interact with a short modal selector on top.

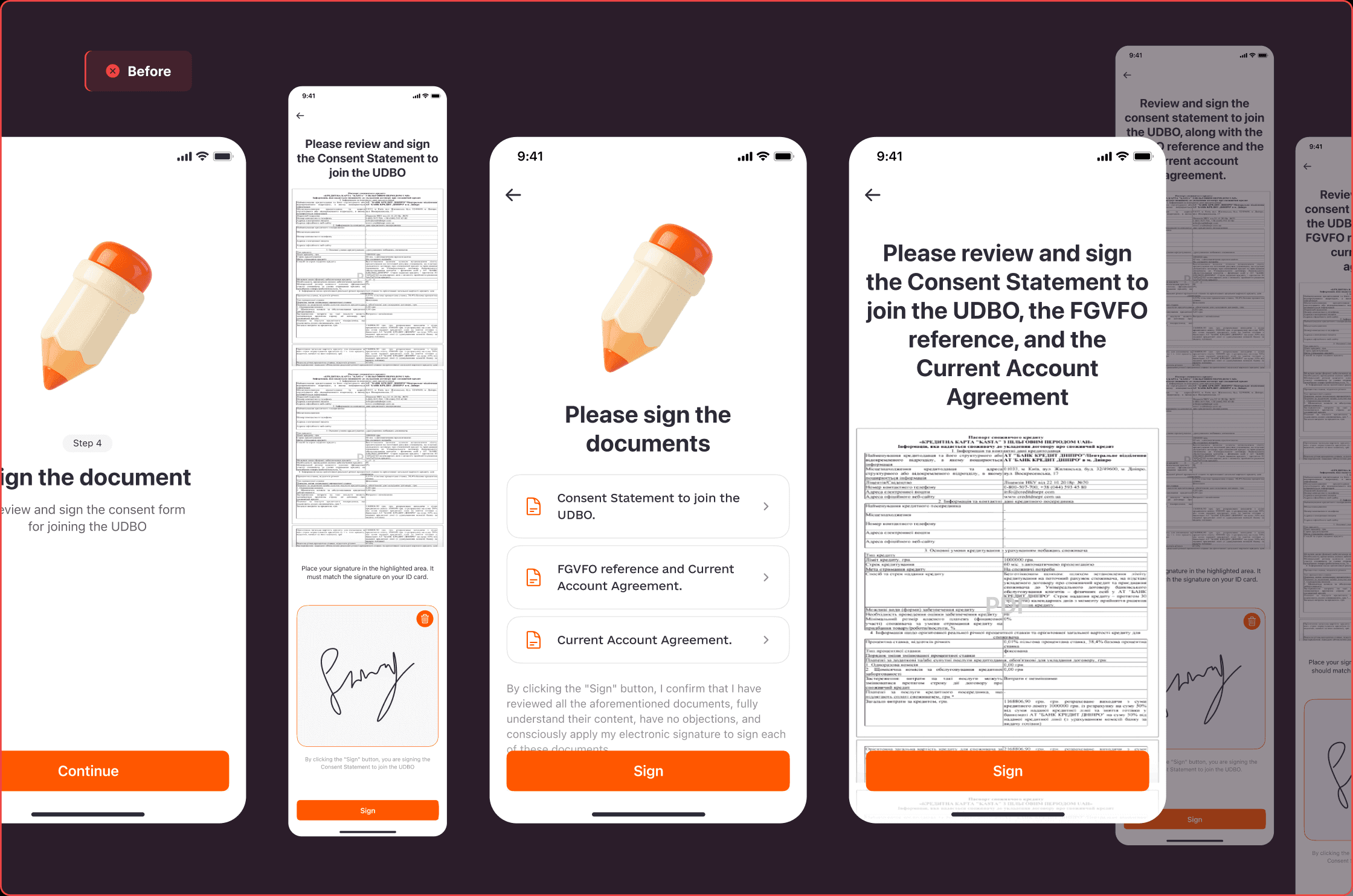

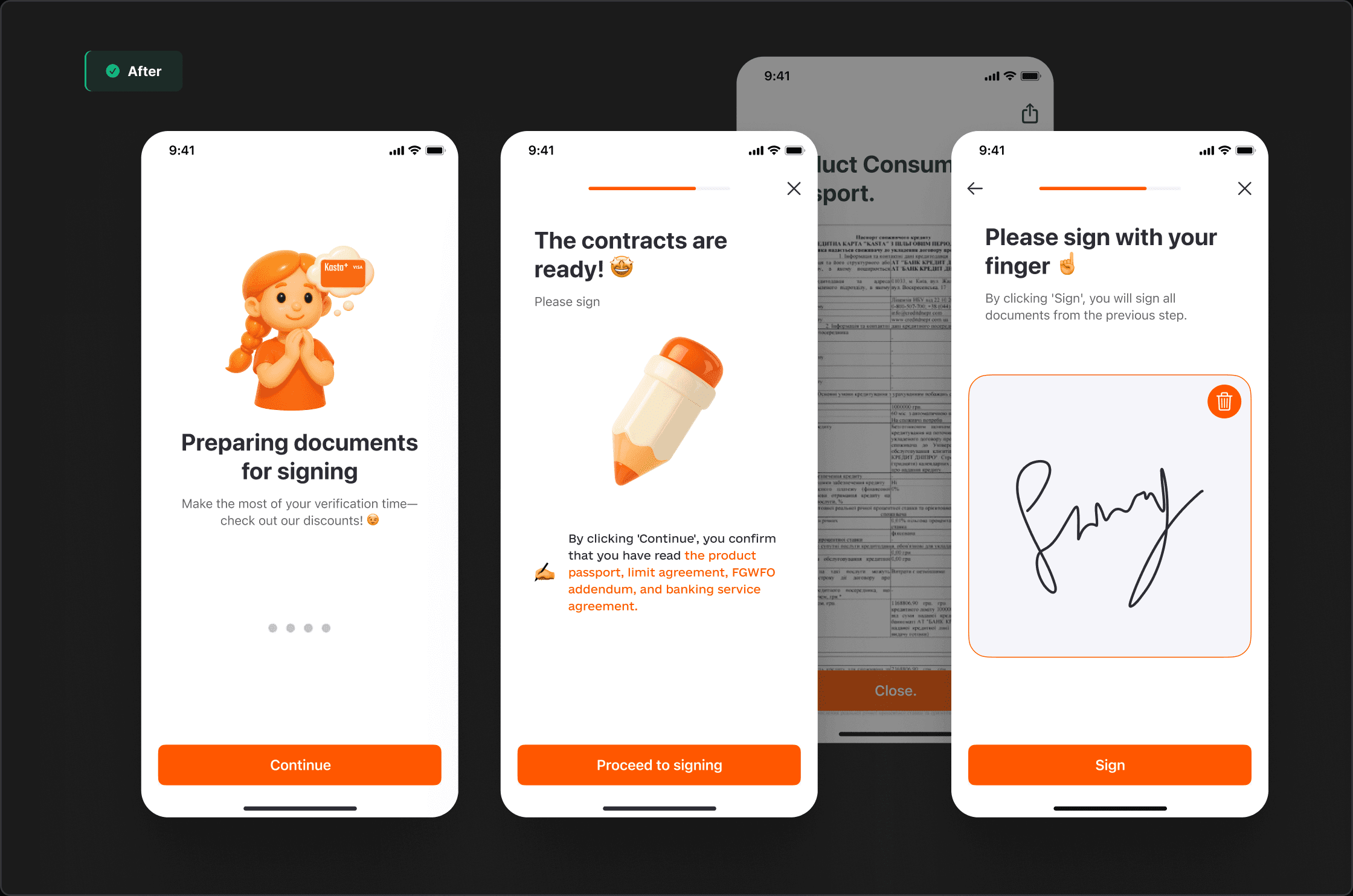

Before:

4 separate contract screens

Users had to open 4 contracts one by one and sign each individually.

Contracts were at the bottom of long screens — many missed the signature area.

Flow took 4 screens and 4 gestures.

After

Single signature flow

Now users see a clear message: “By continuing, you confirm agreement and sign all documents at once.”

One screen, one gesture replaces the entire process.

Added guided finger‑signing animation so everyone understands what to do.

Result: Signing flow cut in half, higher completion.

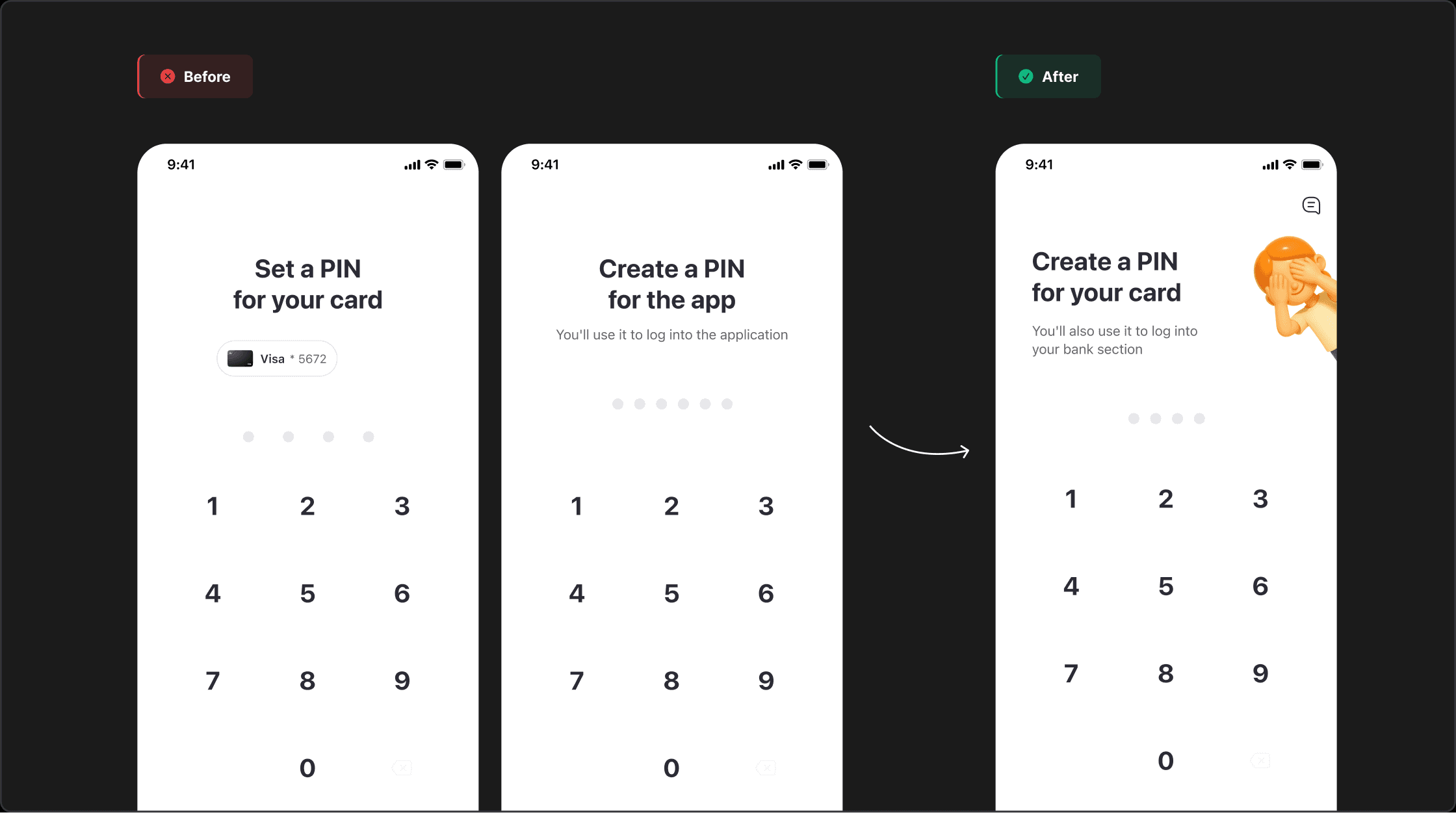

Merged PIN screens

Originally: two screens — 4‑digit card PIN + 6‑digit app PIN.

Now: one 4‑digit PIN for both card payments and app banking access.

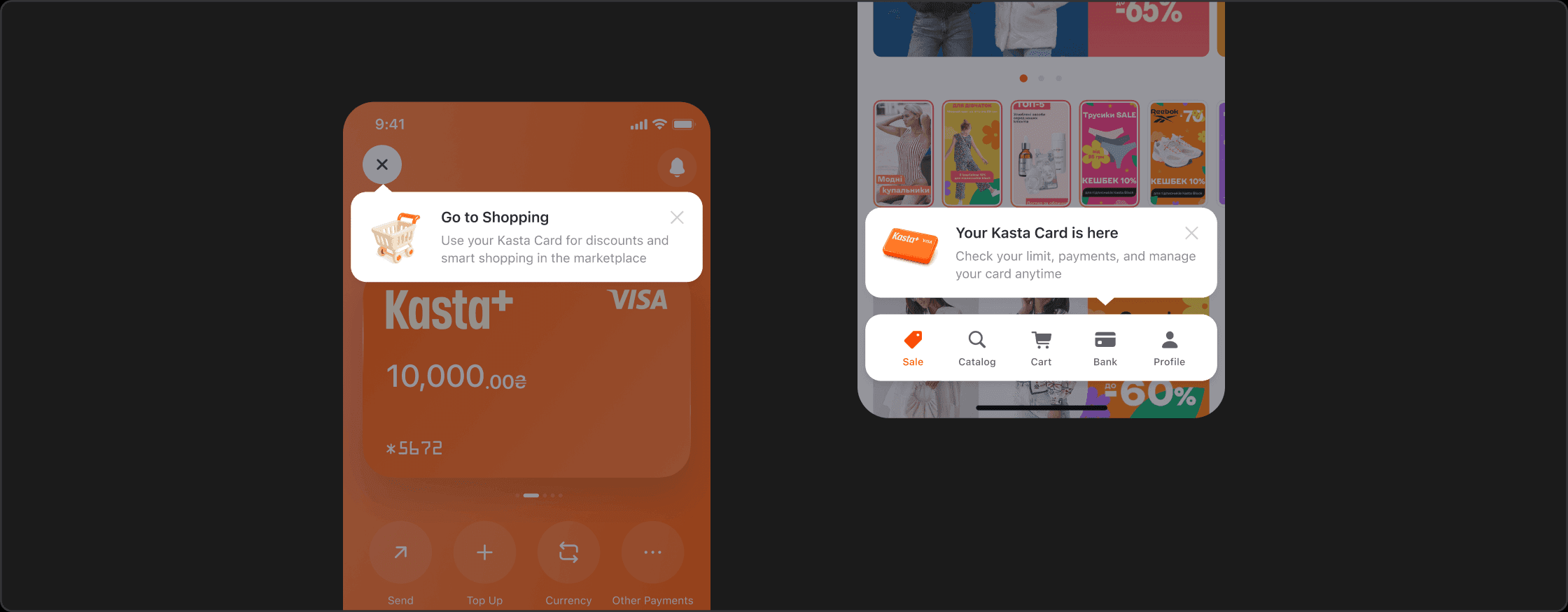

Guided first steps with tooltips

Contextual tooltips guide users after onboarding: to the Marketplace for shopping with card benefits, and to the Banking section for managing limits and transactions.

Result

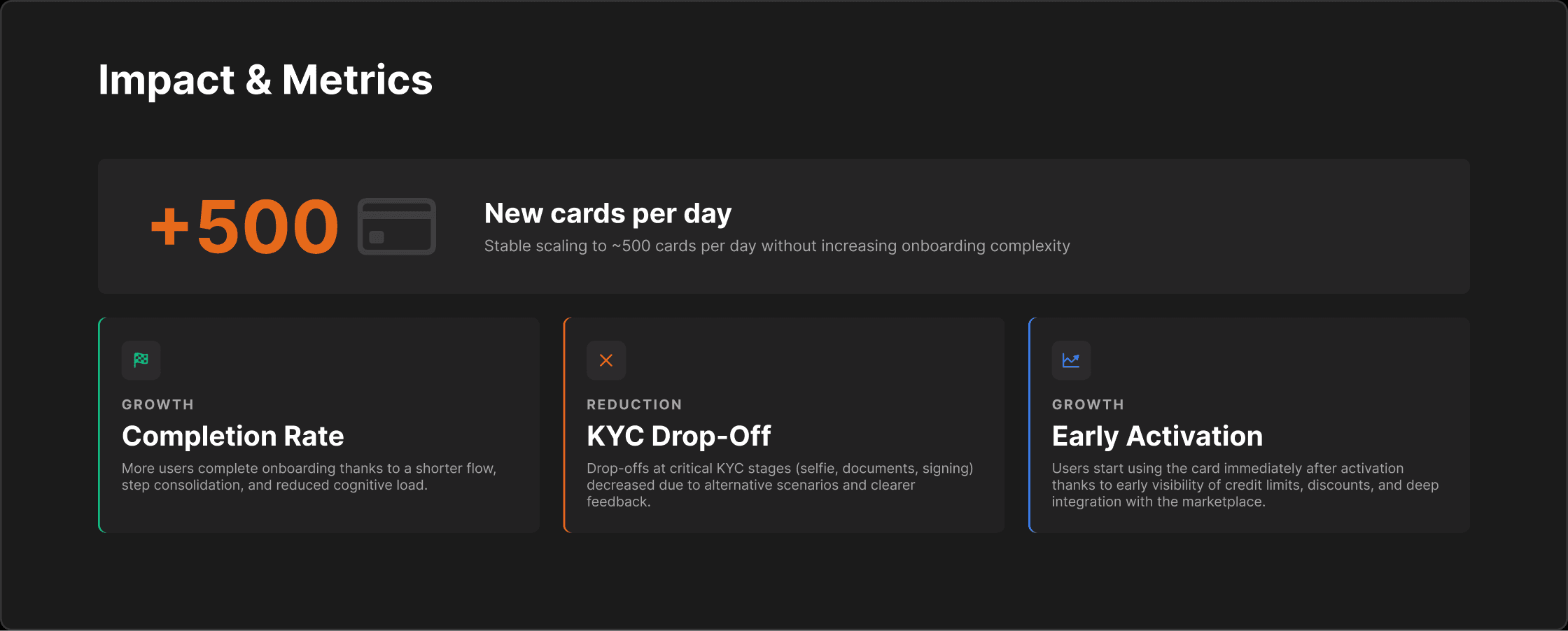

After launching the Fast KYC onboarding, we saw a clear shift in how users opened and started using the card:

+500 new cards per day

The simplified flow with merged steps and clearer paths significantly lowered the barrier to entering the financial product.Completion rate — up

More users finished the onboarding thanks to fewer screens, grouped steps and reduced cognitive load.KYC drop‑off — down

Abandonment on critical KYC stages (ID, selfie, document signing) decreased due to alternative verification methods and transparent feedback.Early activation — up

A higher share of users began using the card immediately after opening, driven by early visibility of limit, discounts and direct integration with the Kasta marketplace.Exact internal numbers are not disclosed, but the pattern is clear: less friction and fear in onboarding led to more completed cards and earlier usage inside the ecosystem.

My role

As Senior Product Designer on this initiative, I:

Led the audit and redesign of the entire Kasta Visa onboarding flow.

Worked closely with product, bank, legal and compliance to respect all regulatory constraints.

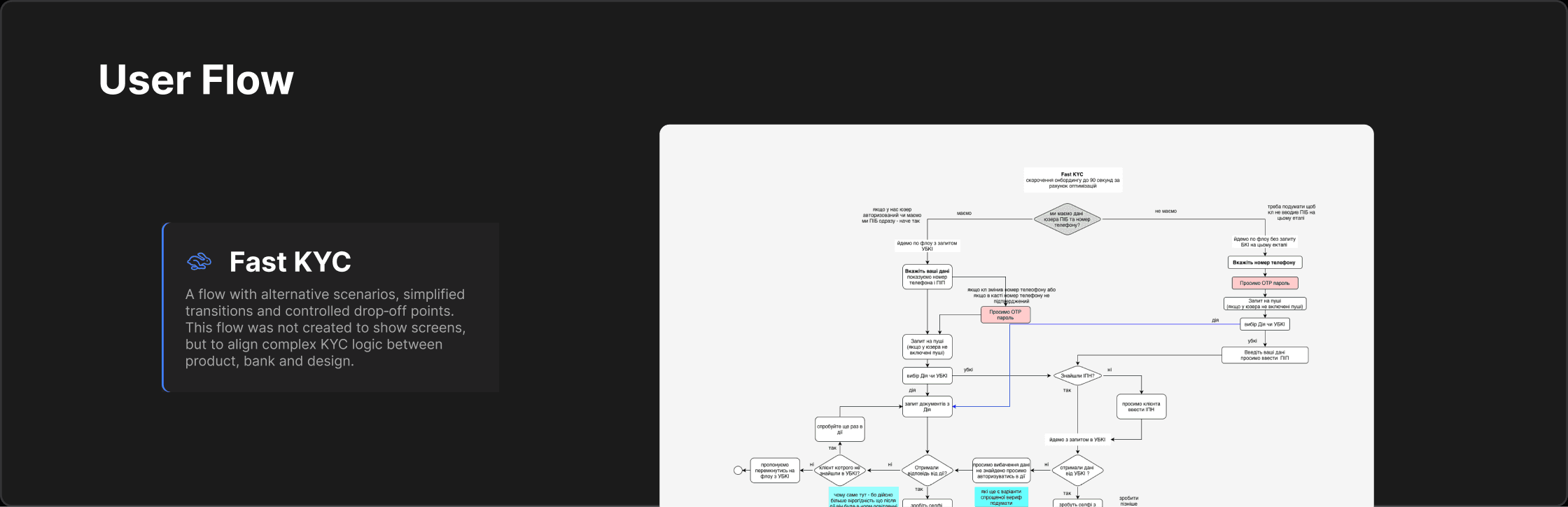

Designed the Fast KYC architecture, including detailed flow diagrams and alternative paths (BankID, Diia, passport).

Created the new UX and UI: adaptive forms, single PIN, single signature, progress and feedback patterns.

Supported implementation, QA and analytics to validate that the new flow improved completion, KYC pass rate and early card activation.

This case shows how a marketplace can integrate a full banking product inside a mobile app by redesigning not just screens, but the entire onboarding service under strict financial constraints.